In the rarefied air of the blue-chip art market, where masterpieces trade for millions of dollars in quiet, climate-controlled rooms, the sale of a major Picasso or Basquiat is a carefully planned event. Big companies like Christie’s and Sotheby’s put together a world of shiny catalogs, academic essays, and champagne-fueled previews to create an air of mystery and drive prices skyrocketing.

The art world paid attention when four outstanding works of art went up for sale: two by Jean-Michel Basquiat, one by Pablo Picasso, and an iconic photo by Diane Arbus. But this wasn’t just any auction. These were not the prized possessions of a knowledgeable collector; they were the stolen goods of a global criminal organization. It wasn’t a well-known auction house that sold the item; it was the U.S. government. And the place wasn’t a fancy salesroom in New York or London; it was a “clunky,” “amateurish” website run by a Texas-based contractor who specializes in selling seized cars and police surplus.

The art pieces were the glittering remains of the 1MDB scandal, one of the most outrageous kleptocracy schemes in history, in which more than $4.5 billion was stolen from a Malaysian sovereign wealth fund. The U.S. Department of Justice (DOJ) took the paintings in a noble effort to get the stolen money back for the people of Malaysia. However, when the DOJ attempted to sell the paintings later, it became a prime example of what transpires when the intricate realms of high finance and fine art collide with the glacial pace of law enforcement.

Many market professionals thought the auction, which ended on September 4, 2025, was not only unusual but also a disaster. It was a sale haunted by the specter of its criminal origins and hobbled by a process that seemed utterly ignorant of the market it was trying to engage. The outcome was a fire sale that likely cost millions of dollars, money that should have been allocated to the victims of the 1MDB scandal.

The 1MDB scandal. This event shows the art market in a bad light, not just because of a bad sale. The art market is a glittering, secretive, and dangerously unregulated playground that serves as the financial system’s most elegant loophole.

The 1MDB Scandal Turned the Art Market into a Weapon for the Kleptocrat

Understanding the nature of the crime is essential to comprehending the reasons behind the auction’s failure. The 1Malaysia Development Berhad (1MDB) fund was set up in 2009 by then-Prime Minister Najib Razak to help the Malaysian economy grow, or so he said. Instead, it turned into a personal piggy bank for a group of corrupt officials and their friends, led by the wanted financier Low Taek Jho, who is better known as Jho Low. They stole billions of dollars between 2009 and 2015 through a complicated web of shell companies and offshore accounts, bribing officials and living in a way that was shockingly luxurious. They used the stolen money to purchase super-yachts, private jets, Hollywood mansions, and even the movie. The Wolf of Wall Street is a compelling narrative that defies logic.

The global investigation has figured out how Low’s scheme worked, even though he is still on the run and is thought to be hiding in China. The international art market was a key part of that plan. Low didn’t love art; it was just a tool for him. It did two things for a kleptocrat: it helped them clean up dirty money and buy a beneficial name.

First, there is money laundering. The art market is a wonderful place to clean up dirty money. It deals with valuable, portable things whose prices are always up for debate. One transaction can cost tens of millions of dollars. Because of a culture of secrecy and the use of middlemen, it is a powerful way to turn traceable wire transfers into real, seemingly legitimate property. Low took full advantage of the situation in an amazing way. In just one year, from 2013 to 2014, he put more than $200 million in stolen 1MDB money into art.

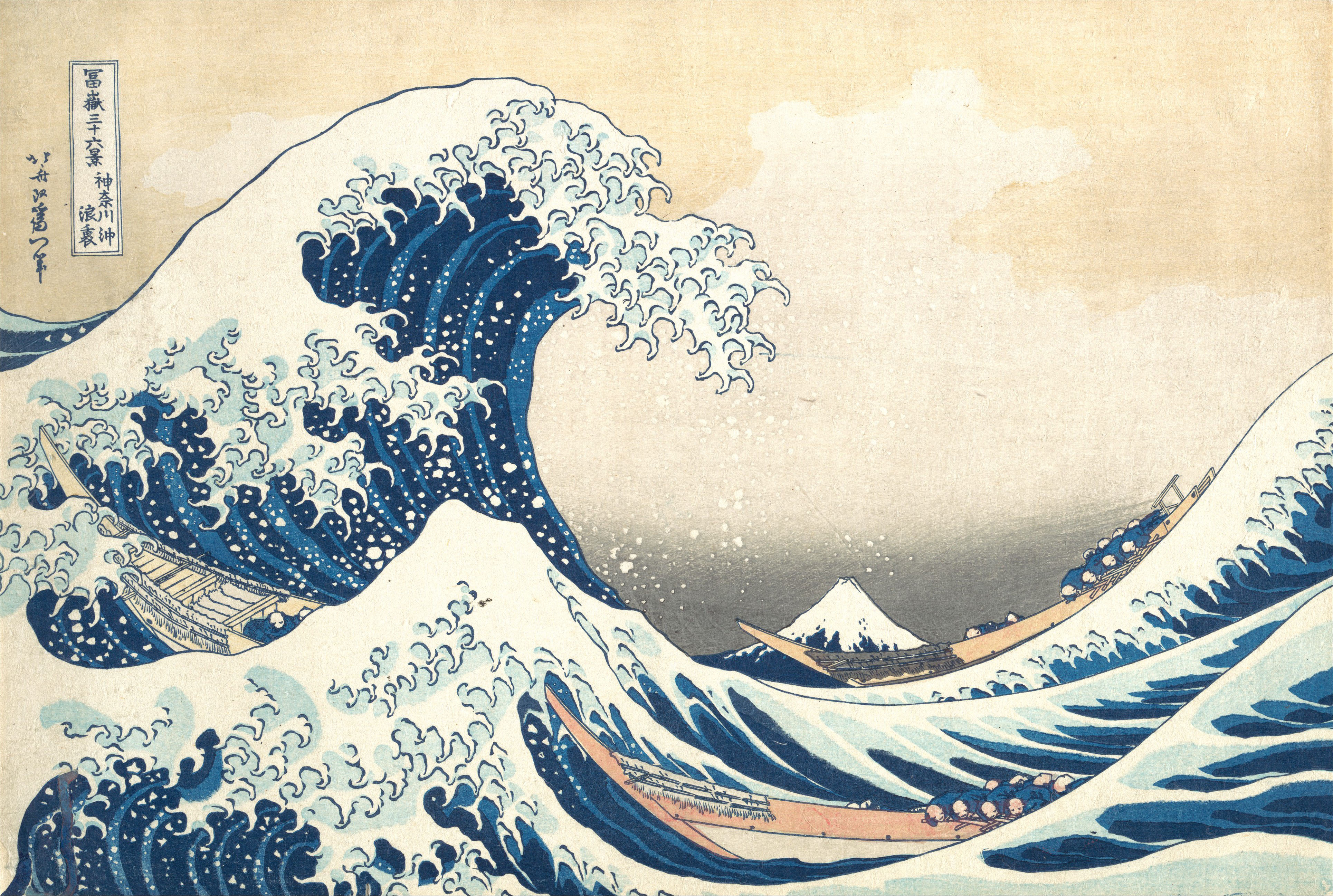

He didn’t often buy things in his own name; instead, he used his friend Eric Tan and a shell company called Tanore Finance Corporation. A senior vice president at Christie’s who was responsible for the account later told investigators that she thought Low and Tanore were “interchangeable.” This case shows how the “see-no-evil” attitude was common. Low’s purchases were huge. In May 2013, he made a significant impact at a Christie’s charity auction, which his friend Leonardo DiCaprio organized. Just two days later, he got into a bidding war to buy Basquiat’s work.

He paid a record-breaking $48.8 million for Dustheads. He paid $71.5 million for a Mark Rothko painting from François Pinault’s personal collection. Pinault is the owner of Christie’s.

The second function is “reputation laundering.” Low bought cultural legitimacy by buying masterpieces. He wasn’t just another shady money man; he was a collector with excellent taste and style. This veneer let him meet the world’s elite, which helped him become friends with DiCaprio, whom he gave art as gifts bought with stolen money. When DiCaprio won a Golden Globe for his role in The Wolf of Wall Street, he thanked Jho Low by name. He thanked Jho Low by name in The Wolf of Wall Street. The art wasn’t just hanging on the walls; it was helping him protect his criminal business by keeping people away from it.

At best, the institutions in the art world were willfully blind. In 2014, when Low wanted a giant loan and used his collection as collateral, his team sent emails looking for lenders who “wouldn’t follow know-your-customer rules too closely.” This wasn’t a warning sign; it was an invitation. Sotheby’s Financial Services gave him a loan of $107 million, which was backed by art stored in the secretive Geneva Freeport. The 1MDB scandal didn’t just reveal a criminal; it also revealed a deeply flawed system and an entire industry that had made it the perfect accomplice by valuing privacy and discretion.

The Forfeited Four: A Look at Their Bad History

All four works put up for sale online by a Texas auctioneer are important pieces by 20th-century masters. From the artist’s studio to the government liquidation sale, their journey reveals the transformation of cultural treasures into tools for criminal activity.

Jean-Michel Basquiat, Red Man One (1982): This painting, which Basquiat made in his most important year, is powerful, raw, and confrontational. It shows the artist’s obsessions with identity, anatomy, and his own “autobiographical struggle.” Before the scandal, it came from the Gagosian Gallery and was sold at Sotheby’s in 2009. Jho Low bought it from the Helly Nahmad Gallery in March 2013 for $9.4 million using money he stole from bonds. He then gave it to Leonardo DiCaprio, who sold it back to the U.S. government in 2017. The U.S. Marshals Service (USMS) set the starting bid at an unbelievable $2,975,000, which is less than a third of what Low paid and even less than what it sold for at auction in 2009.

Jean-Michel Basquiat, Self Portrait (1982): 1MDB funded the purchase of this piece, which originated from Basquiat’s estate and passed through the renowned Robert Miller Gallery. This piece was also created during Basquiat’s important year. Christopher Joey McFarland, one of the co-founders of Red Granite Pictures, the production company behind The Wolf of Wall Street, a business partner of the stepson of the Malaysian prime minister, was present. The USMS starting bid was only $850,000, which is an incredibly low amount for a major Basquiat self-portrait from this time.

This painting by Pablo Picasso, Tête de taureau et broc, is from 1939. It should not be confused with Picasso’s more famous sculpture of the same name from 1942. Low bought it for $3.28 million in 2014. It was another gift for DiCaprio, this time for his birthday. Low wrote him a note that said, “Dear Leonardo, Belated Happy birthday! The painting is a gift for you. TKL.” It was given to the government and sold, just like the Basquiat.

The photograph titled “Child with a Toy Hand Grenade in Central Park, N.Y.C.” was taken by Diane Arbus in 1962. This picture of a young boy with a toy grenade in his hand and a grimace on his face is one of the most famous ever taken. It shows the tension of the time. A low bidder paid an outrageous $750,000 for a print from the edition of 75. The price is so high that it seems more like the deal was about moving a certain amount of money than the print’s market value. DiCaprio was also given this, but he later gave it up. The USMS auction started the bidding at a lowly $4,400, which is less than 1% of Low’s purchase price. This number says a lot about the sale.

When G-Men Become Gallerists: A Culture Clash at Auction

It was the right thing for the government to do to sell these assets. The method was a disaster. The USMS, the agency in charge of selling seized property, followed its usual procedure instead of sending the works to a top-tier auction house that could receive the most money for them. It contracted with Gaston & Sheehan, an auctioneer in Pflugerville, Texas. Their website says that they sell seized cars, jewelry, real estate, and extra stuff from local police departments. They know how to sell things, not how to curate art.

The end result was an online auction that shocked people in the high-end art market. Art consultants and advisors were shocked. The news reported that the auction website was described as “bare-bones,” “clunky,” and “sketchy-looking.” Arushi Kapoor, a well-known advisor, was very clear: “Most of my clients wouldn’t want to sit on this website and bid on it because it’s so bad.” She also said that if someone had sent her the link, she would have thought it was a scam.

The feedback is more than just a complaint about how it looks. In the art world, the sales platform is a part of the product. A reputable auction house provides trust, scholarship, global marketing, and attentive service, establishing a credibility ecosystem that justifies high prices. A big collector isn’t just buying a painting; they’re also buying the trust that comes with the Christie’s or Sotheby’s brand. The USMS process, designed to dispose of fungible goods in a cost-effective manner, was not equipped to handle culturally significant, unique items. The choice to not charge the buyer’s premium, which is a common fee at big houses, could also be considered a sign of an amateur operation.

Artlyst quotes an advisor who said, “Who knew the Marshals Service had a side job in art?” The joke works because it points out a basic truth: when the government treated these works of art like stolen pickup trucks, it told the market that this was a bargain-basement fire sale. It made people less likely to trust the auction, which kept the very wealthy bidders who could obtain the best prices away. This probably cost the victims of the Millions were lost in the 1MDB scandal.

The Tainted Provenance Discount: A Clear Failure

The auction’s financial results were just as disastrous as the website. The final high bids validated all the concerns about a “tainted provenance discount,” exacerbated by a low-cost sales process. The winning bidder paid $3.28 million for the Picasso, but the highest bid was only $1,202,500.

The Basquiat, It cost $852,500 to buy Self Portrait. The Arbus picture that Low used to sell for $750,000 only sold for $10,000. Basquiat’s work is most clearly Low paid $9.4 million for Red Man One, but the highest bid was only $2,975,000, which was the starting price.

The 1MDB scandal’s impact on art sales mirrors this pattern of poor performance. Untitled (Yellow and Blue), a painting by Mark Rothko, sold for 30% less than Sotheby’s Hong Kong anticipated. Low sold an Andy Warhol print that he had given him as a gift for a little less than he had paid for it years before. Reportedly forced to sell works in 2016, Low himself suffered significant financial losses. For example, he lost 45% on a Picasso and 33% on a Basquiat.

“Provenance issues can lower prices,” said Jane Levine, a former executive at Sotheby’s. This “discount” isn’t because people are afraid of doing the right thing; it’s a logical reaction to many risks. First, there’s the risk to your reputation: big collectors and museums might not want to buy something that is so closely linked to a huge crime because they don’t want it to hurt their reputation. This makes the number of top-tier bidders smaller. Second, there is a perceived, if not real, title risk. A sale by the U.S. government should provide you clear title, but the “specter of Low’s involvement” makes things murky.

The third and most important point is that Shady was involved in this situation. A top auction house has a reliable average price, courts specific buyers, and generates conservative land. The USMS contractor just put the items up for sale. One advisor said that this passive approach, along with the shockingly low starting bids, drew in “savvy buyers” who wanted a deal, not trophy hunters who were willing to pay top dollar. The prices that came out were not strange; they were the expected result of a bad process used on a bad asset.

The “Last Mile Problem” and the Playground Without Rules

The DOJ’s Kleptocracy Asset Recovery Initiative is behind this auction. It has done an amazing job with its main goal. To date, the U.S. has recovered and facilitated the return of approximately $1.4 billion in 1MDB funds to Malaysia. The money aims to assist those who suffered the most from the fraud. This global effort, which includes working with law enforcement in Switzerland, Singapore, and Luxembourg, is a victory for forensic accounting and international law.

However, the art auction shows a clear “last mile problem.” The same government system that was very effective at tracking down and seizing assets was not very effective at the last, most important step of turning those assets into cash. To win a civil forfeiture case, you need different skills than to sell a Basquiat. The government failed to secure the best deal for the Malaysian people because it did not adapt its methods to align with the culture of the asset class being sold.

In the end, the whole ugly situation, from Low’s first shopping spree to the government’s clumsy auction, is a direct result of a system that is dangerously broken. The art market in the U.S. is worth more than $28 billion and is still what a 2020 Senate report called the “largest legal unregulated industry in the United States.” Such an outcome isn’t a mistake; it’s a policy choice that has made the art world a haven for thieves, people who break the law, and people who wash money. The Financial Action Task Force (FATF), which is responsible for stopping money laundering around the world, has warned about the risks in this sector many times. The Senate investigation showed how Russian oligarchs used art sales that were not linked to their names to clean up more than $18 million.

The 1MDB scandal is the most famous example of this. Jho Low didn’t need to be a criminal genius to exploit the art market; it was designed to be exploited. Because there were no mandatory Anti-Money Laundering (AML) and Know-Your-Customer (KYC) rules, which are common in all other major financial sectors, dealers and auction houses could ignore the fact that he was using shell companies to move hundreds of millions of dollars through their accounts.

This problem with the system needs a solution that works for the whole thing. Research has demonstrated the complete failure of the voluntary, self-policing model. The bipartisan Art Market Integrity Act is an example of a legislative proposal that would bring high-value art intermediaries under the Bank Secrecy Act. This is an important first step. The five pillars of AML compliance that are common in banking would have to be followed by this law: a compliance officer, written internal policies, employee training, independent audits, and, most importantly, customer due diligence to find out who really owns the money.

The story of the 1MDB masterpieces unfolds in three stages. The first act involved the theft of billions of dollars intended to aid the people of Malaysia. Second, the act of purchasing cultural treasures with the stolen money transforms art into a tool for criminal activity. And finally, the last insult: a poorly run government auction that didn’t receive the full value of the recovered assets, shortchanging the very victims it was supposed to help. The 1MDB scandal has already put a former prime minister in jail. Its last legacy should be to make the art world and the governments that run it finally clean up.

Leave a Reply