The art market was always turbulent, swinging in and out of boom periods and recessions. However, 2024 appears to be a year unlike any other where there are absolute resets with far-reaching effects on artists and artists’ migrants, collectors, galleries, and auctioning establishments. The Artnet Intelligence Report highlights the significant changes in the art world during the first half of 2024, reflecting a market undergoing significant evolution. This reboot is about more than just falling numbers; it reflects long-term changes in approaches to art and its exchanges.

At first blush, the data seem to be bleak and depressing; however, a more detailed explanation would show a market that is attempting to readjust itself within the global context. From unique selling techniques to realizing the need for cooperation, the art world is finding ways within the new normal to provide new avenues for collectors and galleries.

The Market Reset: Forces Driving the Shift

The concept of a’market reset’ appears self-explanatory, yet it is influenced by several underlying factors. A number of factors have combined to significantly impact the art market. From a general point of view, the increase in the rate of interest has lessened the attractiveness of the art market for investors. People who have been in the market in the recent past have come to meet high returns with safe assets like bonds and others.

At the same time, geopolitical factors such as buyer sentiment due to wars in Ukraine or Gaza have an impact. War restrictions have taken away some of the important Russian art collectors. The growth rates in the Asian market, which had previously been high, have slowed down because of market instability in China. The net effect of these factors has been a global artistic sales freeze.

In prior years, the world elite or oligarchy, who were content because of the aggressive financial markets, invested billions into art, which made the price of the most expensive pieces reach disturbing levels. However, currently even the strongest collectors are carefully entering the market. Around this year, and also, the relative decrease in works offered and sold lot sale results have nearly dropped to over thirty, reflecting this new environment of conservatism. High-value purchasers, who previously made enthusiastic attempts to offer such works under the hammer and unsuccessfully outbid others, have become much more restrained, with many preferring to wait on the fence until the market calms down.

Perhaps the most notable aspect is the drastic decrease in the number of items sold. That decline was accompanied by a 26% decrease in the average price earned for every lot auctioned, indicating that even in the middle-class section of the trade, there has been a slowdown in the level of transactional activities. Fewer works are reaching the auctions, and those that do are earning significantly less than they did a year ago.

|

Artist |

Life |

Title |

Date |

Sale Price (USD) |

|

|

1 |

Jean-Baptiste-Siméon Chardin |

1699–1779 |

Le Melon Entamé |

1760 |

$28,981,893 |

|

2 |

Giambologna |

1529–1608 |

Sleeping Nymph |

1584 |

$5,979,000 |

|

3 |

Élisabeth Louise Vigée Le Brun |

1755–1843 |

Self-Portrait in Traveling Costume |

1816 |

$3,085,000 |

|

4 |

Maso Finiguerra |

1436–64 |

Hercules and Antaeus |

late-15th c. |

$2,470,000 |

|

4 |

Jean-Baptiste Greuze |

1725–1805 |

A Girl Weeping Over Her Dead Bird |

1757 |

$2,470,000 |

|

6 |

Anthony van Dyck |

1599–1641 |

Self-Portrait with Upturned Mustache and Raised Left Hand |

1637-39 |

$2,430,000 |

|

7 |

Anthony van Dyck |

1599–1641 |

Portrait of Willem Hondius |

$2,107,000 |

|

|

8 |

Luis Meléndez |

1716–80 |

Still Life of Artichokes and Tomatoes in a Landscape |

$2,056,500 |

|

|

9 |

Salomon van Ruysdael |

1602–70 |

Ships on the Boven-Merwede with Gorinchem in the Distance |

1659 |

$1,996,000 |

|

10 |

Giovanni di Ser Giovanni |

1406–86 |

The Story of Coriolanus: A Cassone Front |

$1,562,500 |

The Decline of Big-Ticket Auctions: The Expansionary Phase of the High-End Market is Over

For quite a while, high-end auctions acted as a decent gauge of the art market index. Recently, the multimillion-dollar masterpiece sales have been able to grab headlines and push the market limit. Works by so-called blue-chip artists like Monet, Picaso, and even Warhol were selling at or above the $50 million mark, where aggressive bidding amongst wealthy collectors and institutions drove up prices. Nevertheless, 2024 has seen a severe slump in this segment.

During the first half of the year, three artists’ works sold for more than forty million dollars; this stands in stark contrast to the previous year’s statistics, where sales in this price range were more common. Expectedly, iconic Monet and Warhol command high prices, yet they typically sell for less than their initial estimates. Although Monet’s Meules à Giverny sold for an impressive $34.8 million, it remains far from the record prices of previous years. Warhol’s Flowers, which sold for $35.5 million, was also a step down from the heights at which his works sold at all.

|

Artist |

Life |

Title |

Date |

Sale Price (USD) |

|

1 Andy Warhol |

1928-87 |

Flowers |

1964 |

$35,485,000 |

|

2 David Hockney |

b. 1937 |

A Lawn Being Sprinkled |

1967 |

$28,585,000 |

|

3 Leonora Carrington |

1917-2011 |

Les Distractions de Dagobert |

1945 |

$28,485,000 |

|

4 David Hockney |

b. 1937 |

California |

1965 |

$23,938,076 |

|

5 Joan Mitchell |

1925-92 |

Noon |

1970 |

$22,615,400 |

|

6 Frank Stella |

1936-2024 |

Ifafa I |

1964 |

$15,280,250 |

|

7 Ed Ruscha |

b. 1937 |

Truth |

1973 |

$14,785,000 |

|

8 Joan Mitchell |

1925-92 |

Chord X |

1987 |

$13,060,000 |

|

9 Robert Ryman |

1930-2019 |

Untitled |

1961-63 |

$11,680,000 |

|

10 Wayne Thiebaud |

1920-2021 |

Star Pinball |

1962 |

$11,335,000 |

It is not only the top-most paintings that exhibit this cooling. Overall, auction houses have been unable to attract the high-value consignments that were once the backbone of the business. The report emphasizes that the absence of marquee masterworks is one of the primary reasons for a decline in revenues. Auction houses are also facing challenges in electronic design and producing extensional sales that create value in terms of cash flow.

Part of this paradigm shift is being caused by changing the behaviors of buyers. Rather than engaging in speculative purchasing, most of the world’s super-rich prefer to invest in more secure asset classes for the long run. In terms of why collectors are holding off art purchases, Barry Becker of Becker and O’Connor Inc. says, ‘People tend to do watershed purchasing for art when the economic factors aren’t favorable for holding novelties.’ This has also led to a reduction in the number of buyers who would have actively participated in the bidding for high-end works of art, thereby exacerbating the market’s stagnation at the upper levels.

|

Artist |

Life |

Title |

Date |

Sale Price (USD) |

|

1 René Magritte |

1898-1967 |

L’ami Intime |

1958 |

$43,065,507 |

|

2 Gustav Klimt |

1862-1918 |

Portrait of Fräulein Lieser |

1917 |

$41,141,270 |

|

3 Claude Monet |

1840-1926 |

Meules à Giverny |

1893 |

$34,804,500 |

|

4 Vincent van Gogh |

1853-90 |

Coin de Jardin Avec Papillons |

1887 |

$33,185,000 |

|

5 Francis Bacon |

1909-92 |

Portrait of George Dyer Crouching |

1966 |

$27,735,000 |

|

6 Francis Bacon |

1909-92 |

Landscape near Malabata, Tangier |

1963 |

$25,115,148 |

|

7 Lucio Fontana |

1899-1968 |

Concetto Spaziale, La Fine di Dio |

1964 |

$22,969,800 |

|

8 Alberto Giacometti |

1901-66 |

Femme Leoni |

1947 |

$22,260,000 |

|

9 Claude Monet |

1840-1926 |

Moulin de Limetz |

1888 |

$21,685,000 |

|

10 Pablo Picasso |

1881-1973 |

Femme au Chapeau Assise |

1971 |

$19,960,000 |

Post-War and Contemporary Art: Perspiratory Press as the Leader of the Market with New Challenges Above Board

It is widely agreed that post-war and contemporary art continue to be the most lucrative market, with an outrageous margin of earnings—$2 billion in sales coming from this sector during the first half of 2024; however, this sector can no longer avoid the recession. To be specific, postwar and contemporary art have declined by 21% compared to last year for the same period, indicating that this most profitable sector of the market has also cooled off a bit.

The cause of this downturn is particularly the dwindling interest in works of too recent vintage with pieces by artists born after 1974. In recent endeavors, both collectors and investors have flocked to young superstar artists, bidding prices excessively high. However, in 2024, the last bubble of this segment finally burst, pushing down sales extremely by 39%. Other successful artists in the contemporary art scene, including María Berrío and Vaughn Spann, have seen their works, which used to cooperate with Snoopy for over 7,000 dollars on purchase, sell for hundreds of dollars. However, this year, a Berrio painting, La Cena, sold for a mere four hundred and forty-one thousand dollars, whereas two years ago, an auction of the same art returned 1.6 million dollars.

This change, however, has led to a change in buyer behavior. Rather than chasing the latest offerings, collectors strive to acquire works that hold future value. Collectors no longer purchase works of young and unknown artists with the intention of reselling them at a higher price, at least temporarily. Instead, consumers are seeking more valuable items that not only capture their attention at that moment, but also demonstrate enduring appeal.

“If a big estate came up, and it was of the quality of Yves Saint Laurent’s or Paul Allen’s, it would An untitled 1984 painting by Andy Warhol and Jean-Michel Basquiat went for $19.4 million at Sotheby’s New York in May. do incredibly well, even now,” advisor Philip Hoffman, CEO of the Fine Art Group, said. “The downside is that the interest rates of 5 percent or upwards are punishing. So people are saying, ‘If I get 5 or 6 percent fixed and art has been dropping in value, I’ll hold off buying art.’”

Collaboration and Innovation: Challenges Faced by Galleries and Auction Houses

showcased flower-themed works.Andy Warhol’s 1964 Flowers sold for $35.5 million in New York in May at Christie’s, which

showcased flower-themed works.

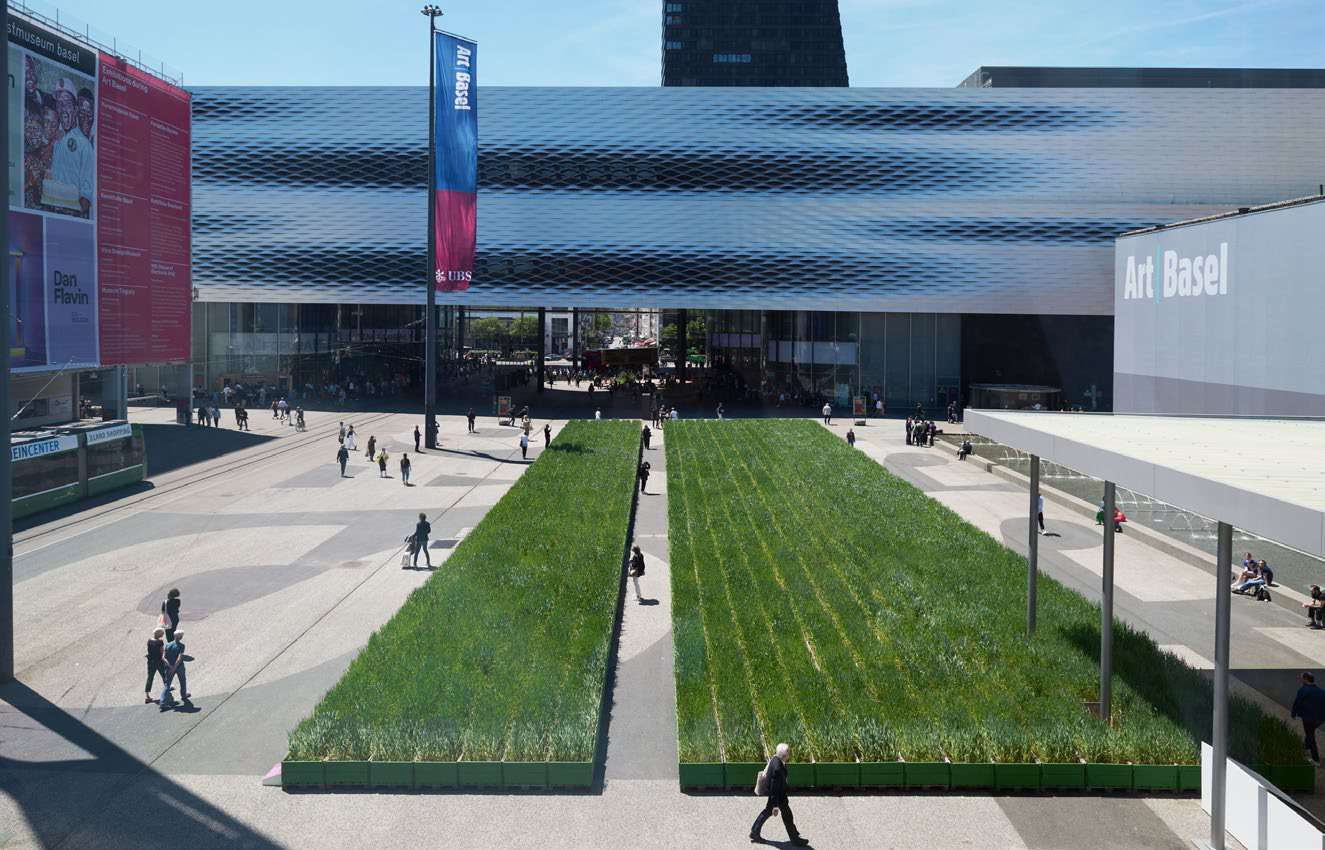

Faced with the difficulties posed by the shrinking market, practitioners have turned to innovation as well as forging partnerships as the main solution for endurance. Galleries and auctioneers have also demonstrated innovative approaches to marketing and selling arts, aiming to attract and thrill art collectors. There has been an increased movement towards shared exhibition spaces, such as at major art fairs like Art Basel, where the trend has grown the most.

During the Paris edition of Art Basel, galleries preferred to work together, regardless of the shrinkage of booth spaces available. Such a collaborative arrangement has allowed galleries to combat the usual heavy losses incurred on showcasing at big fairs, but at the same time, it has enhanced the depth and breadth of the exposing works for the audience’s enjoyment. This approach enables galleries to exhibit a reduced quantity of work while focusing on their presentation with greater thoroughness. This increases the likelihood that households will sell their products when the market is unfriendly.

Auction houses are also utilizing innovative sales techniques to combat the boredom of auction buyers. Sotheby’s auction of ‘The Now’, which focuses on contemporary works, has generated significant interest among young artists. These events manage to steady demand for new art amongst collectors familiar with modern-day artists, offering quirkier instruments than auctions, for example, to enrich an assortment of international artists within a more convenient environment than previously available.

At the same time, auction houses are changing their existing strategies. For instance, Christie’s auction house has been showcasing beautiful flower auctions to its customers, not so much from a marketing perspective as from a theme appeal. For example, Warhol’s works and those of Georgia O’Keeffe were meant to give the audience an element of surprise, especially when so many aspects of life were chaotic at the time. These sales were attractive, with O’Keeffe’s Red Poppy selling for $16.5 million, which was beyond the expected sum of the painting.

Looking to the Future: A Reset Brimming with Opportunities

Despite the negative impact of the 2024 art market reset, it’s important to note that it created numerous opportunities for those with foresight to seize. As prices fall and buyers who are in the market for purely financial returns exit, it is the true art lovers amongst collectors who are reaping the benefits of experiencing the acquisition of masterpieces at much lower costs. More specifically, the gradual decline of the ultra-contemporary market provides collectors with an opportunity to purchase what they could not afford previously.

Even if this is in some way favorable from a financial point of view, there is also a deeper significance in the fact that the reset so far has been possible within the commercial art world. With the exit of investors, visitors, rather than curators, are beginning to acquire the artworks for their real beauty. Just as Christopher Wool had resisted the commodification of his art during his career, he now finds himself at the vanguard of the new paradigm shift. These recent exhibitions make a statement and are particularly in line with the current views of other artists, wherein their works or collections should never be just a means of making money.

For those looking beyond the immediate chaos, the reset in 2024 brings the ability to understand the essence of art once more. “It’s not about being a pack rat anymore,” one collector said. “We are more interested in the work’s purpose than its ownership.” There is a desire not only to possess it, but also to engage with it.

Conclusion: Weathering the storm

A paradigm shift is happening within the art world today. Changes that come as a reset in 2024 affect all stakeholders, including artists, collectors, galleries, and auction houses, requiring them to change strategies, be creative, and make various adjustments. Yes, several of the changes that resulted in shrinking sales and dwindling prices have opened up possibilities for an art market that is calmer, rational, and more passionate about art than mere investment.

Rest assured, the industry will undoubtedly encounter challenges in the future. However, it’s important to exercise caution, as there are risks that, if properly managed, can result in significant benefits. Sure, this reset will be painful, though required—a moment to clean, halt, and review all art practices. In response to these tumultuous times, we can confidently assert that when we bravely embrace change, despite its potential pain, we find that ideas flow most effortlessly.

References: Artnet Intelligence Report Mid-Year Review 2024, Artnet News

Leave a Reply