The Indian art market is multidimensional, with India’s age-old culture blending with the growing modern energy of the new age. India is witnessing one of the most important developments in recent times with Adar Poonawalla’s acquisition of a major stake in AstaGuru, a leading online auction house based in Mumbai. This move coming from the billionaire CEO of Serum Institute of India, a globally acclaimed figure in the pharmaceuticals industry, goes beyond a simple business deal. It symbolizes a powerful infusion of fresh financial resources and strategic planning that is set to transform the Indian art secondary market, bringing in massive growth and technological advancement along with an international presence. This article focuses on the far-reaching consequences of Adar Poonawalla’s entry, speculating on the impact on AstaGuru, the Indian art market’s evolving future, and the paramount shifts such prominent involvement entails for the industry at the precipice of change.

After several decades, the Indian art market has emerged not just as a domain of immense cultural heritage but as a space that is steadily gaining recognition as a serious asset class to invest in.

Transformative titans like Adar Poonawalla bring a business perspective that fundamentally shifts the conversation. One can only hope that his success in growing companies, as well as orchestrating complex cross-border partnerships teeming with creativity, will indeed shape AstaGuru and the Indian art market more broadly. This is about deep impact, not simply philanthropy.

From Vaccines to Velvets: The Ascent of Adar Poonawalla – A New Investment Model in Art?

To appreciate the probable effects of Adar Poonawalla on the art market, it would be helpful to capture his established ways of working. As managing director of Serum Institute of India, the largest vaccine maker in the world, Poonawalla has showcased unparalleled operational prowess, balancing scale with precision in quality, global supply chains, and industry-specific bureaucracy. His business approach tends to be defined by bold visions that are meticulously planned and executed, which implies that his approach to the art space is not likely to be a fleeting whim.

Adar Poonawalla, understood to be one of India’s premier art investors known for his collection of masterpieces, including works by Indian and European old masters, brings far more than just capital. He brings a brand synonymous with global reach and operational excellence. This vision, overshot by AstaGuru’s investment, revealed further expansion of the auction house’s footprint both domestically and internationally, enhancement of transparency, and the leveraging of technology to make Indian art more accessible, ensuring better valuation. This perspective, changing the view of art from a cultural artifact to a strategic global asset, is transformational. The name alone acts as a magnet for attention from almost all investors and collectors, regardless of whether they were actively engaged in the art market.

A Strategic Partnership: AstaGuru’s Coup De Maître

Born in 2008, AstaGuru is an auction house created by Tushar Sethi, focusing on modern and contemporary Indian art. In addition, they dabble in jewelry, fine silversmithing, watches, and even vintage automobiles. Seeing the boom of Indian HNIs and NRIs, AstaGuru filled the market gap with online auctions, making it easier for their customers to access services. This made the partnership with Adar Poonawalla, who acquired 20% of the company’s shares, an astonishing move for the company.

AstaGuru enjoys numerous advantages. Aside from the capital infusion allocated for “technological infrastructure, team expansion”, and “market development”, the infusion of capital and the association with Adar Poonawalla provide invaluable strategic guidance. His international network can unlock doors for consignment and exhibition deals that would have been harder to access previously. Furthermore, his involvement serves as a powerful endorsement that boosts the credibility and brand equity of AstaGuru in an increasingly competitive market that also includes Saffronart. Adar Poonawalla envisions seeing Indian art “correctly valued” on the global market, which complements AstaGuru’s goals of scaling and internationalizing their operations. This synergy suggests concentrated efforts aimed at presenting Indian art as institutional frameworks and sophistication in the global art market.

Shaping the Future of Indian Art: The Consequences of Adar Poonawalla’s Investment

Adar Poonawalla is set to make investments in the Indian art market. This development could bring about several changes:

1. Marking Validation and Increased Liquidity in the Market: The investment made by Poonawalla acts as a benchmark for validating the Indian art market as it increases the recognition of art from India. It also inspires high-net-worth investors, family offices or even institutional investors to view Indian art as an evolving and dynamic asset class. This increased interest in Indian art will lead to improved liquidity and active engagement, along with a stronger system for price determination. Other prominent business investors are also expected to follow the “Poonawalla effect,” which will further fuel investment in the Indian art market.

2. Why Poonawalla Wants to Buy AstaGuru: The International Expansion of Indian Art: Adar Poonawalla has stated that he wants to assist AstaGuru in taking Indian art worldwide. This suggests some level of greater action to promote Indian artists in the international arena, which can include but is not limited to curated exhibitions, participation in global art fairs, collaborations with foreign auction houses or galleries, and many more. His private network and knowledge of foreign markets will be helpful here. The target is not only a spin-off of Indian art for the diaspora value but also to mainstream the Indian art and drown it into the global art discourse.

3. A Leap into the Future: Technology’s New Face with AI, Digitization, and Transparency: AstaGuru is already operating on an online model, but with Adar Poonawalla’s focus on technology use, including AI, there are possibilities for advanced user interaction, intelligent market analytics, and enhanced provenance research in the future. AI could handle art valuation analytics, trend forecasting, and collector recommendations tailored to individual users. While not mentioned by Poonawalla, blockchain technology remains a noteworthy potential application for ensuring transparency and authenticity in art transactions, which is vital in preserving market trust for high-value items. Poonawalla’s SII experience with cutting-edge manufacturing and global logistics might shape an AstaGuru approach that prioritizes streamlined efficiency, data, and technology.

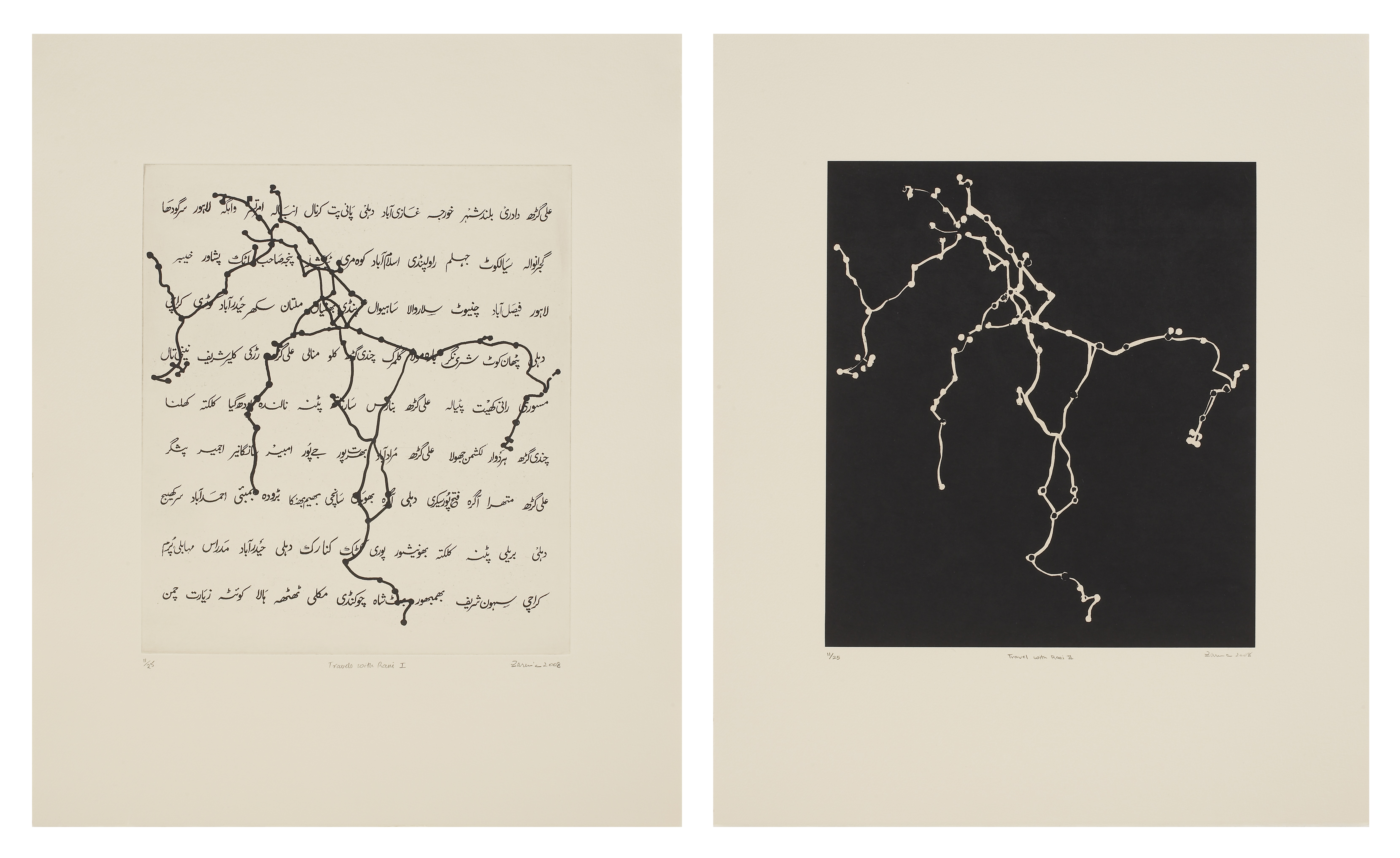

4. Underrepresented Segments of India: Expanding the Practical Framework with Artistic Depth: With AstaGuru’s portfolio currently offering a diverse selection, Adar Poonawalla’s involvement could help encourage further research into some of the more underserved areas of Indian art or newer categories of luxury collectibles. AstaGuru is able to secure more extensive financial and strategic backing, allowing greater risk appetite for historically and artistically significant auctions that are not purely commercially driven, thus enriching the diverse market offering.

5. Market and Competition Development: A weaker AstaGuru will be brought to challenge by the investment of Adar Poonawalla, which will bolster competition in the Indian art auction market. That AstaGuru investment might bring more focus on innovation and improved customer-service standards, increased efforts on scholarly research, and competing commission pricing policies. This has the potential, at least partially, to advance the Indian art market in its professionalization and competition maturity towards the standards in the more developed parts of the world.

Developing Trajectory of the Indian Secodary Art Market

Analyzing the capital infusion as well as the strategic vision of Adar Poonawalla, one can tell it aligns with and accelerates some prevailing future trends in the domain of the Indian art market:

Sustained Growth and a Steady Increase in Liquidity: The Indian art market has shown tremendous resilience and growth with record sales made during the height of the global recession. More recent reports, for example, The Art Market Report 2023 by Art Tactic and Indian Art Investor, have noted some predicted this growth to reach nearly ₹10,000 crores by 2030. With the investment of Adar Poonawalla, the capital available is sure to attract more investment, further reinforcing the growth trajectory.

The Symbiotic Relationship Between Masters of the Modern Era and Emerging Voices of Contemporary Art: Contemporary Indian artists are garnering attention globally. Modernist masters like M.F. Husain, V.S. Gaitonde, Tyeb Mehta, and Amrita Sher-Gil continue to achieve record prices and their paintings fetch ever-increasing sums: earnings of Husain’s “Gram Yatra” at ₹37.7 crores and Sher-Gil’s “The Story Teller” working ₹61.8 crore showcase this ever-increasing value. A well-funded auction house such as AstaGuru, under the influence of Poonawalla, can actively promote newly emerging contemporary talents and build a more stable ecosystem that would balance established talent with emerging contemporaries.

Digital Hegemony: Online Platforms as the New Salons The pandemic greatly impacted the art market’s shift toward technology, and online auctions are here to stay. AstaGuru is aligned with this trend because of its digital-first philosophy. Further developing its online platform, particularly with Web3 features or enhanced virtual viewing rooms, could strengthen its competitive advantage. Adar Poonawalla’s focus on technology indicates a willingness to accept this digitally driven future, which opens opportunities for the dispersed, geographically younger collector demographic.

Indian Art on the Global Stage: A New Chapter with Adar Poonawalla as a Potential Ambassador Apart from AstaGuru’s initiatives, Adar Poonawalla can act as a cultural ambassador for Indian art. His visibility and connections can initiate conversations and build infrastructure needed to introduce Indian creativity to a global audience that may be unfamiliar with its breadth and richness. This is pivotal for the reversal of the undervaluation of Indian art and asserting its rightful position in the narrative of art history.

The Sophistication and Investment Savvy of Indian Collectors — Evolving Profiles: The Persian rugs, ancient bronzes, or colonial-era paintings once held at the innumerably wealthy Indian homes have now been swapped with art by Indian contemporary artists. Alongside traditional collectors, new wealthy entrepreneurs, young working professionals, and financially savvy Non-Resident Indians (NRIs) are making headway into the Indian art market. With increased sophistication and higher expectations of transparency and value, such Indian art collectors come with an immense amount of research done beforehand. The interest and participation of Adar Poonawalla and some foremost names in Indian industry echo the belief that contemporary art does add value and is not only a collectible but also a sound investment with tangible returns.

Market Regulation, Authentication, Ethics, Following an Era Influenced by Adar Poonawalla: The growing intricacy and value associated with the art market come with a greater need for enhanced regulations and strict industry boundaries as far as authentication, ethics, and overall market professionalism are concerned. Even though India has the Antiques and Art Treasures Act, 1972 and the Copyright Act, India still lacks focus on the secondary market and its dealings with provenance, forgeries, and price manipulations. There exists an unmet market need waiting to be filled by rigorous standards set forth by Adar Poonawalla.

Untapped Angles and Remaining Hurdles

Although many view Poonawalla’s move to the art market positively, there exists a more graduate-level understanding critical toward challenges, opportunities, and eventual callout:

The art world holds particular speculative risks: Poonawalla’s immense wealth and influence, representative of a shift in trust capital, could lead to the rampant purchase of undervalued pieces and, ultimately, to hoarding. While many may argue that the Indian art market is underappreciated, too much lackadaisical spending devoid of true art lover engagement could lock it in volatility. The focus must always concentrate on authentic value and balance.

Grabbing too much power may erase distinctness and flavor: Orderly functioning of fascination may erode away if market dynamics creep toward a consolidated bidding structure controlled by greedy auction houses or players with deep pockets. There exists a risk of promotion toward a narrow pool of favored artists, which could dilute preference and recognition of novel, creative, and experimental works. Balancing representation remains extremely critical.

Emerging Artists and Smaller Galleries: Although there is a saying that ‘a rising tide lifts all boats,’ the increased competition and shift to higher-value sales at major auction houses serve as a headwind to smaller independent galleries and emerging artists who do not have the means or connections to participate at that level. In this case, efforts to sustain the grassroots of the art ecosystem will be essential.

The “Gatekeeper” Phenomenon: Powerful and wealthy individuals such as Adar Poonawalla often become, whether by intention or not, potent gatekeepers. Their preferences and where they choose to invest have the capacity to determine market trends and even change narratives in art history. These individuals often have the ability to create profoundly positive impacts, but in order to safeguard a diverse ecosystem of art, this awareness must be part of the discourse.

Working Towards Quite backwards after an arm’s-length transaction on the art market, due diligence on provenance, authenticity, and legal title becomes all the more scrupulous based on the value at stake. Adis Poonawala’s name comes with no less than the highest standard of ethical practice, especially for a growing venture that strives to widen its audience beyond national borders. On the other side, the brunt of ethical scrutiny seems to rest on AstaGuru’s shoulders.

A Change Agent Towards A New Era of Indian Art

AstaGuru’s acquisition by Adar Poonawalla marks an investment milestone in the Indian art market. It indicates a more than superficial monetary investment; it denotes a symbiotic partnership that integrates a global industry leader into the epicenter of India’s cultural economy. The probable outcomes of this transformation suggest increased market confidence and adoption, greater penetration on the global stage, technological leaps, and intensified inter-market competition.

Ultimately projecting a future where Indian art receives greater respect and valuation on the global stage. Achieving this goal will equally necessitate careful consideration of the hurdles to be overcome, ensuring that all sustainable growth remains ethical, inclusive, and sound. The “Poonawalla palette” certainly expands the possibilities for bolder strokes and vibrant new colors in the canvas of Indian art. If these prospective synergies are approached with clear-sighted strategy, unwavering transparency and sincerity toward the breadth of Indian creativity, then it would be reasonable to suggest that this collaboration can fuel a paradigm shift that reinterprets the Indian art market from a resounding regional success story to a truly international phenomenon. The ultimate measure of success goes far beyond achieving record prices at auctions. It includes the enhancement of institutional rigor, engagement of scholars and curators of Indian art across the world, and the flourishing of the diverse, dynamic, and robust artistic ecosystem that promises to bloom with the involvement of Adar Poonawalla.

Leave a Reply