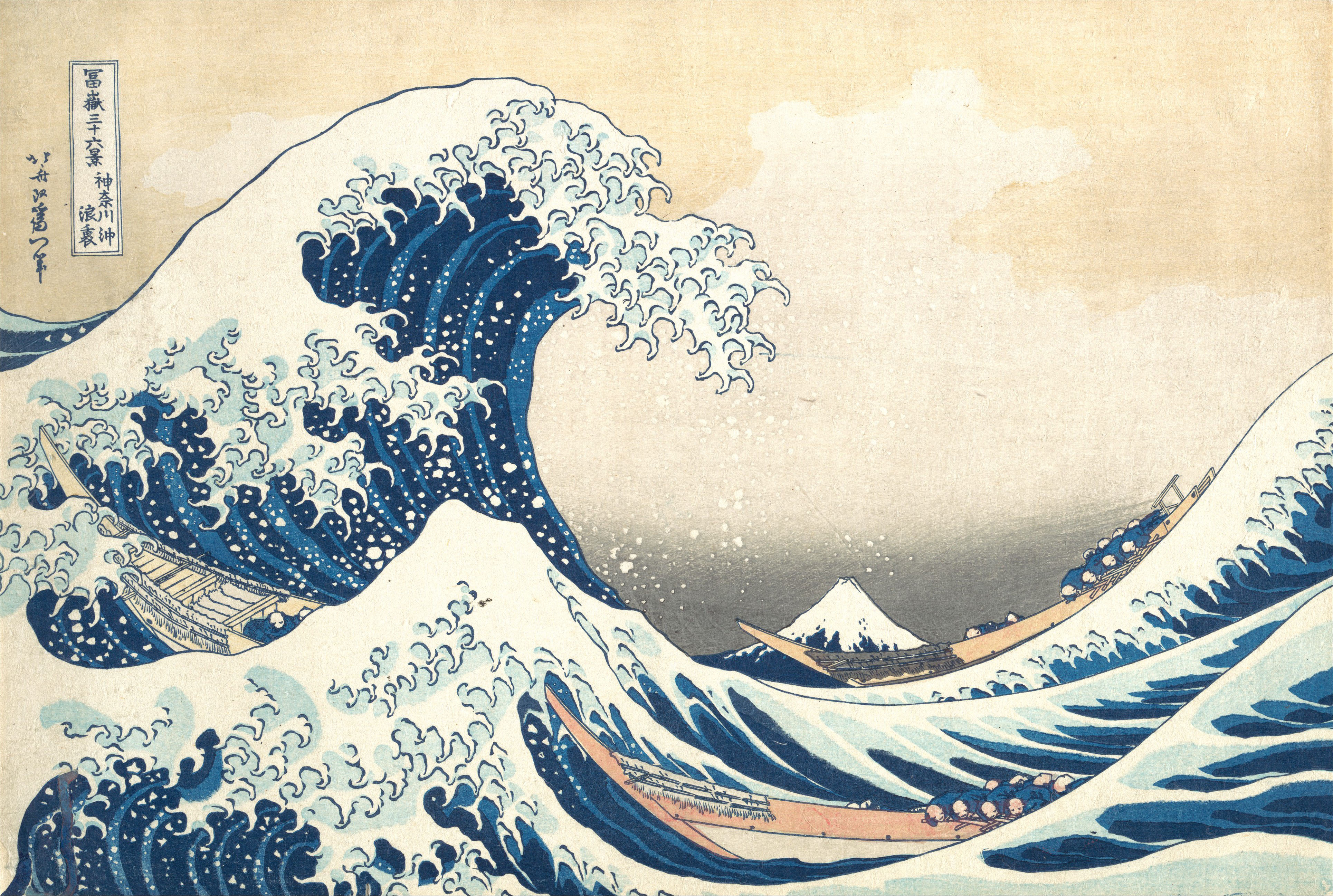

The recent “Masterpieces of Asian Art from the Okada Museum of Art Auction,” hosted by Sotheby’s Hong Kong, not only broke the previous sales record, but it also set a new standard for how East Asian art assets are valued around the world. The event ended with a record-breaking total sales figure of HK $688 million (US $88 million). It also achieved the prestigious “white-glove result,” which means that all 125 lots offered were sold. This amazing performance, which was made possible by unique supply and high global collector demand, proves that East Asian canonical works are strong, high-growth, blue-chip investment assets. The sale of Katsushika Hokusai’s famous woodblock print, The Great Wave: Under the Wave off Kanagawa (Kanagawa-oki nami-ura), was the most talked-about part of this high-stakes and highly anticipated auction. The print achieved a record-breaking price of HK $21.7 million, equivalent to an astounding US $2.8 million. To reach this final number, the price had to go up almost three times its pre-sale high estimate. This huge difference between the traditional institutional appraisal and the actual market value means that the valuation models used for pristine examples of Ukiyo-e masterpieces need to be changed in a big way. The overall success of the sale, on the other hand, tells a bigger story: the huge financial total is supported by a large, steady demand base, and the market has faith in the long-term capital preservation potential of these assets.

The Contextual Framework: Where Curatorial Depth and Legal Necessity Meet

The unusual financial results of this auction must be looked at in light of the sale’s unusual beginnings, which were caused by factors outside of normal market supply. The collection, known for its deep historical and curatorial value, was broken up by a sudden drop in supply unrelated to the market, rather than by normal estate planning or institutional collection rotation.

The Okada Collection’s Importance for Curators

The assets’ inherent quality played a big role in the sale’s success. Nicholas Chow, the chairman of Sotheby’s Asia and the global head of Asian Art, stressed how important the collection is by saying it shows “3,000 years of some of the best ceramics, crafts, and paintings from China, Japan, and Korea.” This wide range of assets made sure that the items sold were high-quality examples of important works from a wide range of East Asian art history.

The catalog showed its scholarly integrity by including masterpieces from many different areas. These included important Chinese artifacts, like bronzes from the late Shang dynasty and imperial Qing porcelain, like a bajixiang vase from the Qianlong period. They also included important Korean ceramics and, most importantly, the masterpieces of Japanese Ukiyo-e. The fact that all of these different categories perform so well together proves that the collection put together by the Okada Museum of Art is of the highest quality. This gives institutional investors confidence in the assets’ provenance and desirability. The intense bidding was based on the fact that there was so much material from thousands of years of Asian art history.

The One-of-a-Kind Legal Catalyst That Made the Sale Happen

The unusual market conditions, especially the huge estimate overruns, are directly related to the legal requirement for the sale. The collection’s sale was a forced liquidation that was ordered by a court in order to raise the money needed to pay a $50 million legal bill owed by museum founder Kazuo Okada as a result of a high-profile business dispute. This situation led to a crucial market condition: the forced sale of irreplaceable, high-quality assets.

When a court order makes sure that a museum’s most valuable items, not just its lesser works, are sold, it guarantees quality and scarcity. This one-of-a-kind supply that wasn’t based on the market caused a big scarcity premium. Because there was a limited and high-stakes chance to buy these items in these specific situations, bidding competition across all 125 lots became much more intense. This was important in getting the 100% sell-through rate and the final total of HK $688 million. So, the high level of interest from collectors was not just because the market was growing naturally; it was also because of the unique financial situation of the sale.

The Institutional Validation: The White-Glove Result

Getting the “white-glove result” is probably the most important structural sign of the market’s current health. It also proves that Sotheby’s did a good job and that the collection is of high quality. This number shows that all 125 lots were sold, which means that the sale rate was perfect at 100%. A perfect sell-through rate across such a large and diverse catalog shows that the global market for vetted East Asian art is very deep and liquid.

This result shows that collectors are very confident, not just in the headline lots like Hokusai’s The Great Wave, but in the whole collection’s scholarly integrity. The white-glove status is very important because it sets this event apart from other high-value auctions where some lots don’t sell, which shows that there is a strong and wide demand base for the huge amount of money that was raised. The outcome confirms the widespread belief among institutions that these assets can keep their value and even grow over time.

The Star Lot: A look at the money and history behind Hokusai’s The Great Wave

The sale of Katsushika Hokusai’s The Great Wave at the Sotheby’s Hong Kong auction marks a turning point in the value of Ukiyo-e art. This famous woodblock print set a new record that has not only gotten people talking about it, but it has also set a new high for the value of Ukiyo-e.

Hokusai’s The Great Wave Sets the New World Standard for Ukiyo-e Prints

The Great Wave: Under the Wave off Kanagawa is the most well-known piece from Hokusai’s famous Thirty-six Views of Mount Fuji series. The print sold for HK $21.7 million, which is US $2.8 million. This result set a new world record for the print right away, showing that perfect copies of this masterpiece are now worth more than anyone could have imagined for a medium that can be reproduced. The final hammer price shows that the item is worth a lot of money around the world and is very important evidence of how strong the current market demand is.

This valuation changes how the market sees the reproducible woodblock print medium in a big way. The intense demand was clear in the eight-minute bidding war that broke out for the lot, which created a new level of investment. The result sees perfect Ukiyo-e prints, especially the famous Hokusai’s The Great Wave, as more than just fine art prints; they are also unique, valuable artifacts. The impression’s rarity and quality have been recognized as the most important factors, going beyond the traditional place of prints in the art hierarchy.

Estimate Volatility and Analyze Market Overrun

The huge difference between the pre-sale high estimate and the final hammer price of Hokusai’s The Great Wave is a major concern for market analysts. It was said that the final sale price of US $2.8 million was “almost 3 times its high estimate.” If the final price is about three times the high estimate ($H), then the pre-sale high estimate was about US $0.93 million (or HK $7.2 million).

This inferred estimate range is similar to the estimate range for another important Hokusai print in the collection, Sudden Rain beneath the Summit, which was up to HK $8,000,000. The market’s clear willingness to go well beyond the high estimate—by more than 200%—shows that traditional institutional estimates for pristine, canonical Ukiyo-e masterpieces have been fundamentally outpaced by the hyperinflationary demand created by global competition. This big difference is a structural sign that the art market is pushing the limits of traditional ways to value such masterpieces.

Comparison to Similar Hokusai Market Dynamics

The $2.8 million print record set by Hokusai’s The Great Wave needs to be carefully compared to the recent value of Hokusai’s original, one-of-a-kind paintings. In a recent sale in Tokyo, Hokusai’s painting Beauty in Snow, with Inscription by Shokusanjin (1813–19), sold for a record price for one of the artist’s unique works, bringing in about $4 million (¥621 million).

Art market analysts find it very intriguing that a woodblock print, even though it was a rare impression, was worth 70% of a major unique painting. This is because it is a reproducible medium. This market behavior shows that for works of such high status and quality, the value can go beyond the usual order of media. The value of rare Ukiyo-e prints has gone up to almost the same level as that of major original works when it comes to investment value. This proves that Ukiyo-e is a capital-protected asset class.

Complete Auction Financial Metrics and Market Segmentation

The sale’s overall performance gave a lot of financial information that shows how strong and deep the market is for vetted East Asian art.

A Detailed Look at Total Sales Performance

The total sales amount for the Okada Museum of Art’s Masterpieces of Asian Art sale was HK $688,343,000, which backs up the headline total of US $88 million. When this total was spread out over the 125 lots, the average lot price was very high, at about HK $5.5 million (or US $704,000). This high average price shows that the assets sold are of very high institutional quality and are highly sought after by serious collectors and investors.

The success was spread out over a wide range of items, which showed that the market was very interested in the whole catalog. Nineteen of the 125 lots sold for more than $1.2 million, not including the star print. The fact that there were so many high-value results shows that competitive interest and strong buyer enthusiasm were not just focused on a few trophy items, like Hokusai’s The Great Wave. Instead, they were spread out across the whole catalog, showing that there is a strong and active buyer base at all levels of collecting. The event’s size and financial depth prove that the market is stable and liquid.

Breaking down buyer demand and regional strength

The successful sale of $88 million worth of various assets with a perfect sell-through rate shows that there is a strong and global demand for high-quality East Asian art. The fact that the collection includes items from 3,000 years of history shows that bidding was equally strong across all categories.

The auction’s success depended a lot on a lot of non-Japanese buyers. This included old Chinese bronzes, like the Ya Yi fanglei from the Shang Dynasty, and Qing porcelain from the imperial period. The fact that these segments did well under the “white-glove” banner shows that people in different Asian collecting categories have a lot of buying power at the same time. This is a good sign for the overall health of the East Asian art market index. The choice to hold this historic sale in Hong Kong strengthens the city’s position as the main hub for buying and selling the best Asian art in the world, setting price benchmarks in both HKD and USD.

Execution by institutions and the future direction of the market

Sotheby’s Hong Kong’s operational execution was key in turning a legally tricky asset distribution into a record-breaking cultural and financial event. Sotheby’s showed great operational excellence in handling a collection with so much historical weight and legal complexity that it had to be broken up by a court order. The auction house’s ability to handle tough asset sales is proven by the fact that they were able to get a white-glove result in these high-stakes situations. The huge estimate overrun, especially for the star lot, Hokusai’s The Great Wave, suggests that there was a smart strategy before the sale. The pre-sale estimates were purposely low, which is a common way to encourage competitive bidding. However, the final results were much better than even the most optimistic internal projections. This performance shows that the market is really picking up, which is making it hard to use traditional appraisal metrics for canonical masterpieces. As a result, Ukiyo-e estimates need to be completely recalibrated.

There was an interesting modern strategic dynamic that came up around the institutional execution, centered on CC Xichu Wang’s (@cc.x.w) role as the auctioneer. Wang, who is Sotheby’s Director and Head of Business Development for Greater China, successfully handled 19 of the lots, including the record-breaking sale of Hokusai’s The Great Wave. This shows that she is very good at selling high-value items.

Wang’s profile became a big topic of conversation in the public eye because of her “impeccable attire” and “stylish presence,” which caused a lot of buzz on social media. This observation shows that top auction houses are changing their strategies in the modern world, especially in the Asian market, where they are trying to combine the seriousness of fine art sales with modern luxury and lifestyle branding. By showcasing professionals who combine the “gravitas of a high-stakes art auction with the relatable, trend-aware sensibilities” of a youth-oriented global audience, Sotheby’s uses an important institutional tool to broaden its appeal and draw in a new, highly engaged group of wealthy buyers, which will help the market grow and stay liquid in the future.

Hokusai’s The Great Wave sold for $2.8 million, which will be a strong new price anchor for the secondary Ukiyo-e market, especially for Katsushika Hokusai’s Thirty-six Views of Mount Fuji. The fact that this price was reached for a woodblock print changes the value of everything else around it.

Sellers of other rare Hokusai prints, especially those of the same high quality or from the same famous series, will now set their reserve prices much higher, closer to or above this new standard. The record quickly resets the high-end secondary market by making it clear that pristine Ukiyo-e is now an investment-grade item and discouraging low estimates in the future. The market now knows that very rare and high-quality items, even those that can be copied, are worth as much as major original unique works. This “Great Wave” effect will spread across the whole segment, changing the way people invest in it for good.

How institutional collectors should invest

The results of the Okada sale give institutional collectors clear, strategic advice on how to navigate this newly defined market. Now, the investment strategy needs to be based on three main things: proven provenance, clear quality, and smart diversification.

The high price for Hokusai’s The Great Wave shows how much people want art that is in almost perfect condition, has sharp impression quality, and has bright colors. Investors need to be very choosy because the market is likely to split into two parts, with museum-quality pieces getting the best prices and pieces in worse condition getting the worst prices. In a market that is very competitive, focusing on assets with verified museum provenance, like those from the Okada collection, gives you an important layer of assurance about their historical quality and authenticity, which lowers the risk. The quality of the impression has been shown to be one of the most important factors in determining investment value.

Because all of the assets sold out, including Chinese bronzes, imperial ceramics, and Japanese masterpieces, investors should use a strategy that includes highly vetted, top-tier examples from a variety of East Asian collecting categories. This strategy lowers risk by not putting all of its money into the now very overvalued Ukiyo-e segment, which is seeing hyperinflationary demand after Hokusai’s “The Great Wave” set a record. The auction’s overall success shows that assets have been liquid for the 3,000 years of Asian art history it represents.

The Sotheby’s Hong Kong Masterpieces of Asian Art from the Okada Museum of Art Auction is a historic event that marks a major change in how East Asian art is valued. The total sale of HK $688 million and the white-glove result show that the market is still confident and there is a lot of liquidity around the world, even when supply is affected by outside, non-market forces.

The record-breaking sale of Hokusai’s The Great Wave for $2.8 million raises the bar for canonical Japanese art by a huge amount. This clearly shows that traditional appraisal methods are having a hard time keeping up with the huge demand from collectors. The fact that a woodblock print that could be made again was worth 70% of a major unique Hokusai painting is a strong sign that for works of art that are famous and of very high quality, the value goes beyond the usual hierarchy of media. This proves that Ukiyo-e is a capital-protected asset class.

This sale proves to institutional investors that high-quality East Asian art is a strong, valuable asset class that can handle shocks to supply and changes in the economy. In today’s market, it’s important to focus on high quality and strong provenance. At the same time, it’s important to realize that institutions like Sotheby’s are successfully using modern marketing techniques to reach more high-net-worth buyers around the world. This auction is strong and undeniable proof that East Asian masterpieces must be included in sophisticated global investment portfolios.

Leave a Reply