Preceding Christie’s spring sales was the backdrop of high-stakes geopolitics, marked by cautious hope. America and China, only a few hours before the sales opening, announced a 90-day tariff pause, which visibly settled tensions for Bonnie Brennan, the newly appointed chief executive. However, the anxiety stemming from the Riggio and Anne Bass collections indicated that the art market still had its economic and political uncertainty shackles on.

Christie’s Spring Sales: A Reflection of Collector Confidence

Christie’s spring sales are almost synonymous with the anxiety stemming from the subconscious state around the New York evening auction marks. Rather than moving inventory this year, Christie’s decided to pivot and opted for more than fifty percent inventory coverage via third-party guarantees. Pieces that couldn’t garner real competition are often backed up by external lenders in hopes for untainted outcomes, rendering the supplying auction house in permanent debt. Auction houses like to keep themselves in the dark, even if it means undermining genuine sale temperature.”

Christie’s hosted two principal events: the private collection sale of 38 works from the Barnes & Noble founders and the 20th century evening auction of 37 lots that included notable pieces from the late Anne Bass. Combined, both sales reached $489 million, within estimates for presale ranges of $272 million for the Riggio collection ($252m – $326m) and $216 million for the modern evening sale ($194m – $260m), both figures excluding post-auction fees. However, these headline figures conceal a more intricate reality where risk-averse aggressive strategies and a subdued bidding market dramatically suppressed exuberance.

Brennan herself noted the quotable contradictory outcomes: “We unlocked supply, brought good results to our consignors,” but added, “We would have liked to have seen more bidding.” Their strategy, consisting primarily of irrevocable bids—structured beforehand—provides certainty but lacks the drama that attracts fat checks and attention. Indeed, only four lots did not sell (one was bought in and three were withdrawn), demonstrating the effectiveness of guarantees supplied and sell prices (94% effortless bid competition).

Concetto spaziale, In piazza San Marco di notte con Teresita by Lucio Fontana is arguably one of the most covered outcomes, seeing as the monumental slashed canvas sold for $7.5 million, including fees. While this price is still quite hefty, it reflects a 42% loss from the $14 million it garnered at Christie’s in 2017, showcasing the fragility of the work’s value and the postwar status icon market. On the plus side, the market seems to have renewed demand for lower-tier works, with female surrealist pieces leading the charge. The recent record set by Dorothea Tanning’s “Endgame” (1944) selling for $2.3 million and Remedios Varo’s “Revelación” (1955) achieving $6.2 million proves this.

Courtesy Christie’s

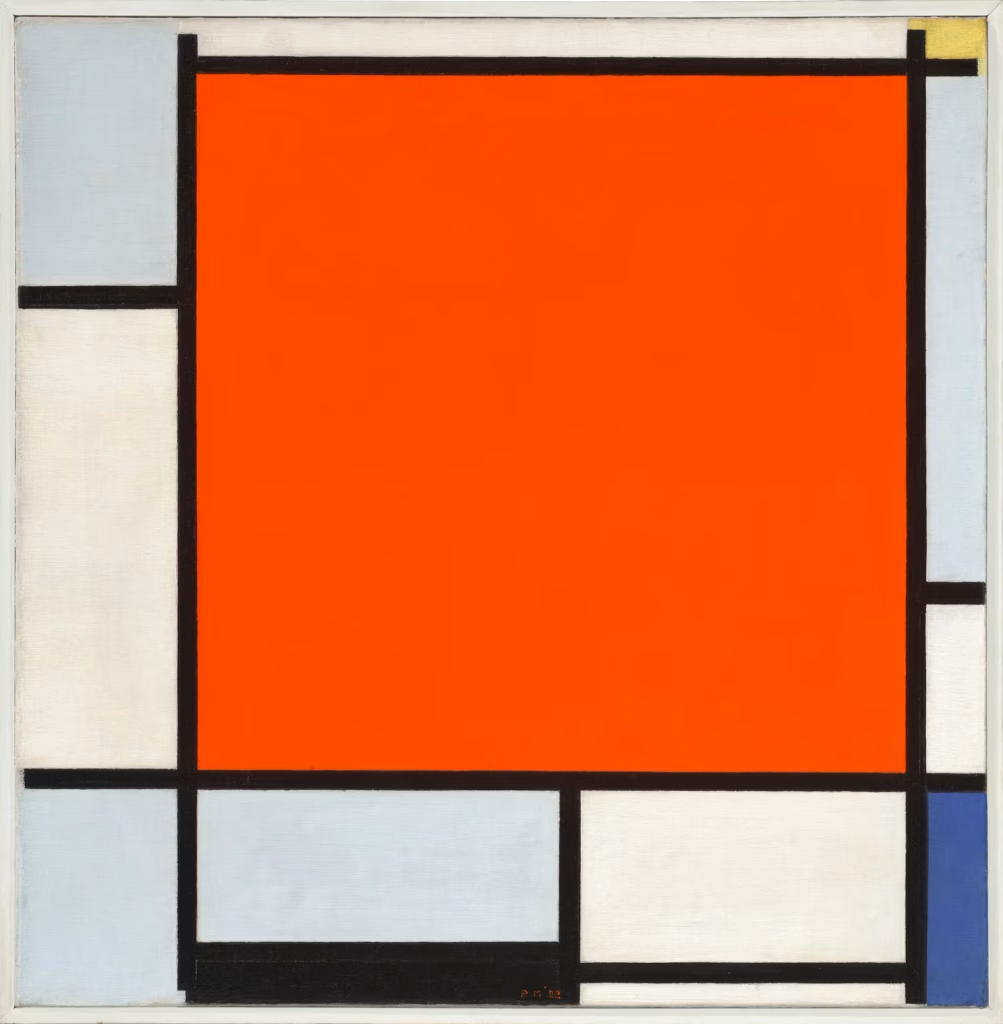

The star of the evening was “Composition with Large Red Plane, Bluish Gray, Yellow, Black and Blue” (1922) by Piet Mondrian. Estimated at around $50 million, it was poised as a possible record breaker after Sotheby’s set a $51 million benchmark for a Mondrian in 2022. Christie’s Rotter walked away with the piece at $41 million, or $47.6 million with fees. While absolutely impressive, the result still underperformed chasing records, which solidifies that cautious buyers are not willing to risk expenditures beyond their comfort zone.

A more puzzling example is an artwork from the “Empire of Light” series by René Magritte, whose works sold for $30 million and later for $34.9 million, including fees. It was observed in the 2023 sale at Christie’s that demand for surrealist pieces remains steady, even if their sale prices aren’t jaw-dropping. The second evening sale peaked once more when Monet’s “Peupliers au bord de l’Epte, crépuscule” went for $37 million. Monet’s piece had been hotly contested and sold for a premium of $42.9 million. It stands to reason that there is still a sustained appetite for traditional impressionist paintings regardless of the increasing competition from modern and contemporary artworks.

Not every lot drew heated competition, however. It was very revealing to note the last-minute withdrawal of Warhol’s “Big Electric Chair” and speculation that it was offered without a price only to be estimated around $30 million. In Hoffman’s words, the lead offer made was “around 10 million under the price the seller would take, which he considered a “massive” divergence” given the circumstances.

The strategic avoidance of risk not only affected the pricing of the auction but also how Christie’s Auction House presented the auction itself. With Adrien Meyer at the rostrum for the Riggio sale, his trademark humor couldn’t bring strong participation, and the session progressed more with polite cooperation than robust competition. While the season’s guarantees may have protected consignors from the risk of not selling their artwork, they also stripped away the suspense that usually energizes the event and the art-collecting community.

Like all good analysts, they’ll most likely evaluate these results in the context of the US-China tariff thaw. The three-month reprieve is a substantial form of relief for both consignors and buyers. Although whether this relief will lead to more aggressive bids is uncertain. The cautious optimism evinced by last night’s sales suggests that while political stability can alleviate fear, it does not guarantee the return of speculative confidence that characterized the peak of the art market crescendo.

With Sotheby’s Modern auction coming up later this week, market sentiment is ready to be measured once again. If Sotheby’s does not provide a boost in engagement, Rotter’s statement “we largely satisfied our clients” could sound quite empty. Due to the combination of large economic factors, changing demographics of art collectors, and new strategies from auction houses, every hammer strike this season works as a tactical vote of trust or doubt.

To sum up, Christie’s spring auctions provided a cautious yet measured confirmation of value, mitigated by conservative enthusiasm and tempered by risk aversion. Marked-down outcomes from once-trendy modernist canvases coexist alongside record prices for under-recognized Surrealists and spirited bidding for Impressionist staples. While operational success is conveyed through a striking 94% sell-through rate, the muted market fervor paired with a weaker pace over motif-framed capture suggests more systemic concerns: how far beyond comfort-zone assets will collectors seek, and can auction houses dampen the visceral risk-mitigation thrill that garners press and price-inflating volatility?

As the rest of the spring sales week unfolds and progresses, focus will inevitably shift the other way to Sotheby’s and beyond. Whether the tariff truce serves as a stimulus for more audacious brand bidding or nervy market stabilization remains uncertain. For the moment, Christie’s approach provides bottom-line predictability and, for some consignors, peace of mind, while the enduring question of recovery and restored optimism remains tantalizingly unresolved.

Leave a Reply